India’s startup and technology ecosystem is witnessing the emergence of a growing pool of influential founders turning into funders by backing multiple domestic funds. In the latest instance, CaratLane founder Mithun Sacheti and Flipkart cofounder Binny Bansal have become anchor LPs (limited partners) in Bengaluru-based Xeed Ventures, an early-stage fund run by Sailesh Tulshan, said multiple people in the know.

The Rs 600 crore fund, formerly known as 021 Capital, has also roped in Premji Invest as an LP, the people added. While Bansal is a sponsor in a dozen funds, Sacheti, who scored a big win by selling his 27% stake in online jewellery marketplace CaratLane to Tata group’s Titan for Rs 4,621 crore last year, has been actively deploying capital across different vehicles. He is a general partner and LP in Singularity Growth, a fund backed by ace capital markets investor Madhu Kela.

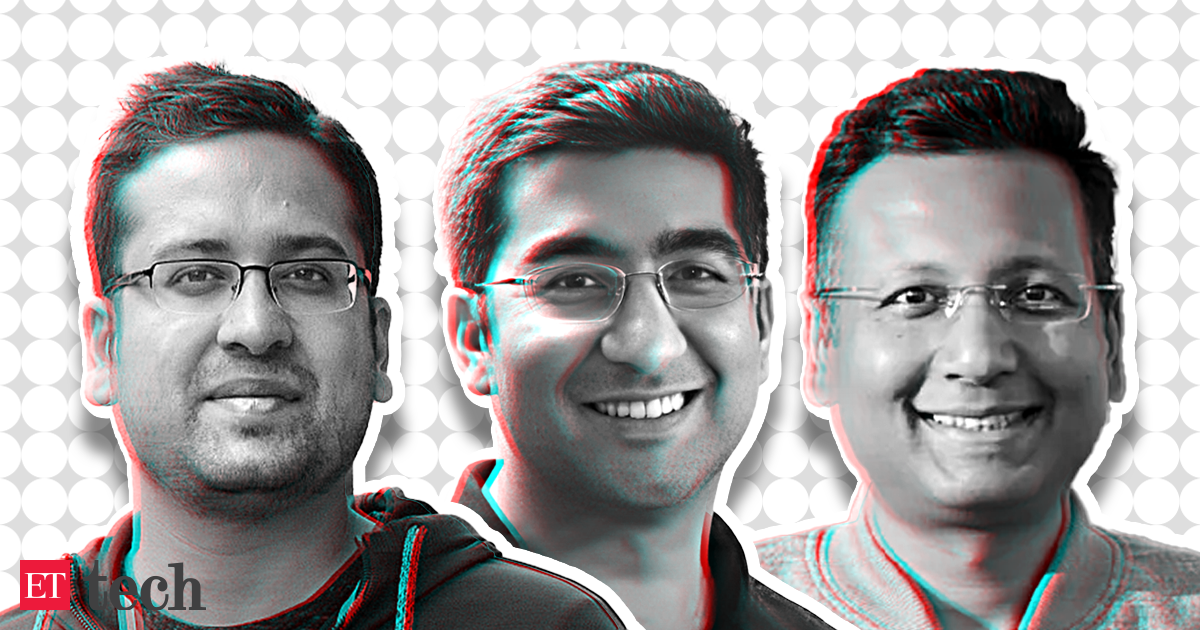

“Bansal and Sacheti are the anchor LPs in Xeed which was relaunched as Tulshan’s independent fund a few months ago. 021 was perceived as being an extension of Bansal’s family office…,” said a person familiar with the development, who did not want to be named. The investment committee (IC) for Xeed will comprise Tulshan, Bansal, and Sacheti.

Xeed, a play on the word seed, will look to cut cheques below $1 million and make 20-25 investments from the fund. It will continue to focus on enterprise, B2B, and fintech deals. Xeed has closed a few investments like Charcoal.inc, a direct-to-consumer brand, and a financial services startup Kredit.pe.

Tulshan, Bansal, Sacheti, and a spokesperson for Premji Invest did not respond to ET’s queries.

021 Capital was formally launched in 2019 by Tulshan, who managed the personal investments of Sachin Bansal, who is not related to Binny Bansal. This coincided with the sale of online retailer Flipkart to US retail behemoth Walmart in a $16 billion deal.

Premji Invest and Sacheti were backers of 021 Capital Fund-I as well. Along with its Rs 300 crore Opportunities Fund which was raised separately, in total the vehicle had garnered Rs 600 crore.

There is another set of entrepreneurs who have taken on the role of full-time investors like Snapdeal’s Kunal Bahl and Rohit Bansal who run Titan Capital.

Most of these founders began ploughing their personal capital about a decade ago via angel investments. Having found success, many have since formalised the structures through which they invest by either turning into LPs or launching their own funds.