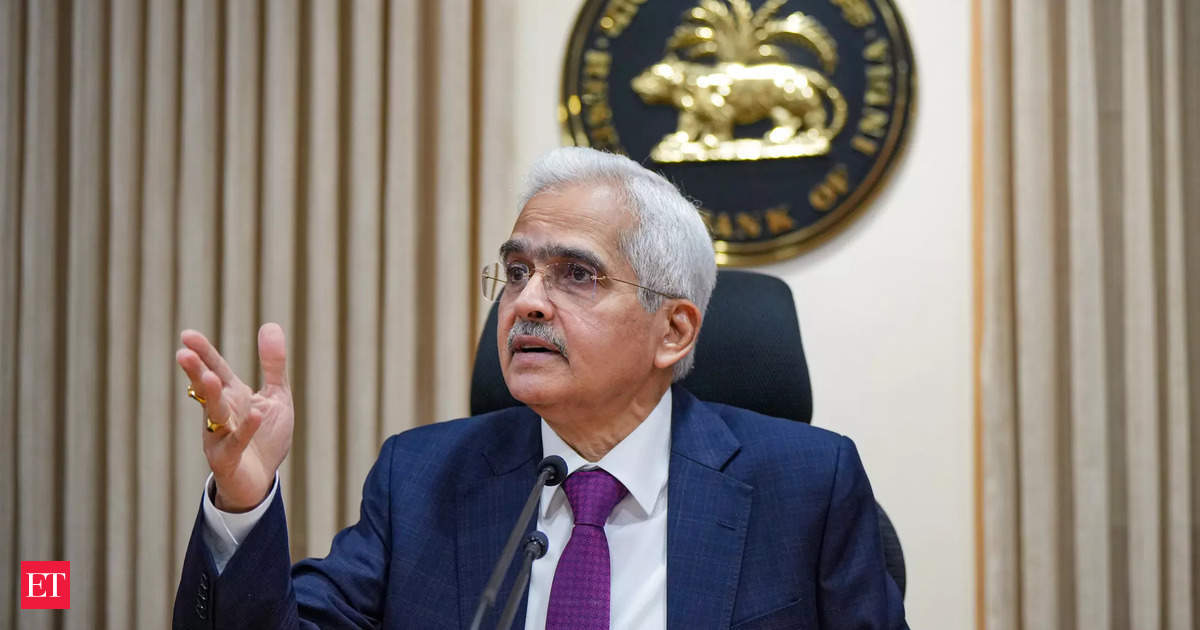

Governor Shaktikanta Das has suggested that permanent deletion of transactions can make the e-rupee or central bank digital currency (CBDC) become anonymous and make it at par with paper currency. Speaking at the BIS Innovation Summit, Das said India is also working on making the CBDC transferable in the offline mode along with introducing the programmability feature to help its financial inclusion goals.

Since the introduction of the CBDC in late 2022, concerns about the privacy aspect have been raised. Some argue that the electronic nature of the CBDC will leave a trail of its usage, unlike cash which offers anonymity.

Das believes that anonymity can be achieved through legislation or technology. Permanent deletion of transactions is an example of how anonymity can be maintained. He emphasized that CBDC should have the same degree of anonymity as cash, neither more nor less.

In the past, Reserve Bank of India (RBI) officials, including Das, have asserted that technology can address concerns about privacy. Former RBI Governor D Subbarao raised the issue of data privacy in 2021, stating that the CBDC would grant the government or the RBI access to all data on the usage of each unit of currency. He called for a strong data protection law to address this concern.

Das also highlighted the need to make the CBDC transferable in the offline mode. One of the advantages of cash is that it does not require network connectivity to be used. In February 2022, Das announced the implementation of offline and programmability features of the CBDC. Programmability will enable transactions for specific targeted purposes, while offline functionality would facilitate transactions in areas with poor or limited internet connectivity.

Despite the efforts made by the RBI, Das acknowledged that the unified payment interface (UPI) remains the preferred mode of payment among retail users. However, he expressed hope for a shift towards CBDC in the future. The RBI has enabled interoperability of CBDC with UPI.

CBDC has been made non-remunerative by the RBI, as it is non-interest bearing. This is to mitigate the potential risk of bank disintermediation. The central bank creates the CBDC, and the banks distribute it. To enhance the reach of the e-rupee, non-banks are being included in the pilot project. Their reach can be leveraged for the distribution of CBDCs and the provision of value-added services.