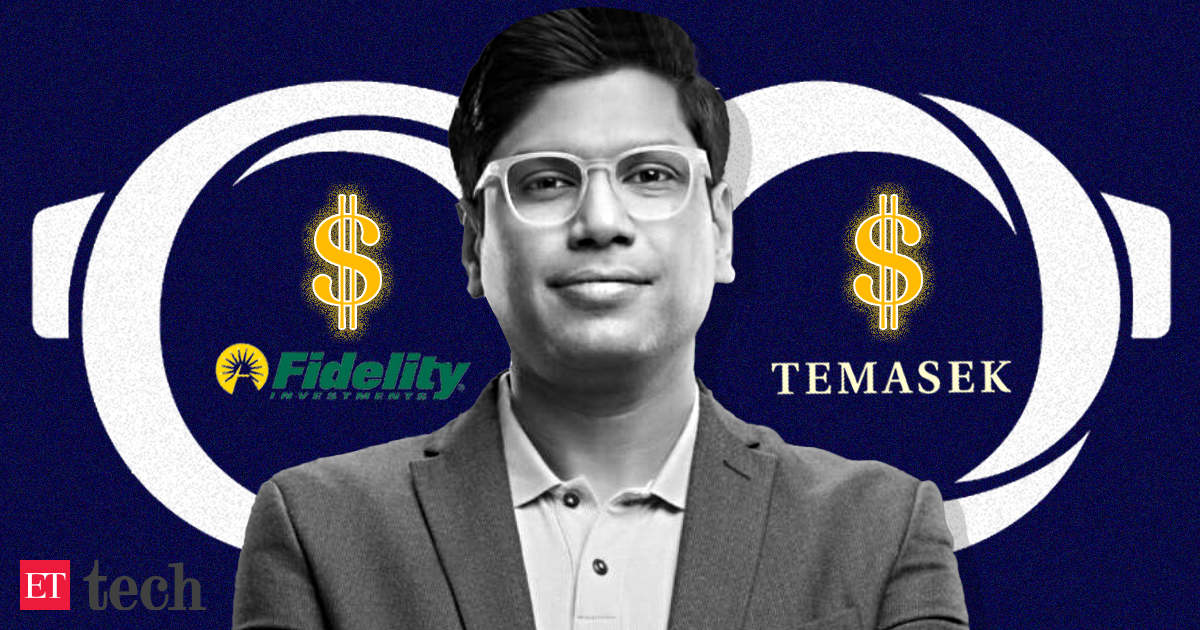

Singapore’s Temasek and US-based Fidelity are in advanced discussions to invest approximately $200 million in Indian eyewear company Lenskart. The investment would take place through a secondary share sale, valuing Lenskart at around $5 billion. This valuation would put Lenskart’s worth at over three times that of Warby Parker, a New York-based online retailer for spectacles and contact lenses. The round would significantly increase Lenskart’s valuation, setting it apart from other similar transactions that usually close at a lower valuation. Temasek is expected to lead the round by investing $125-150 million, while Fidelity is set to contribute the rest. While Temasek is an existing investor in Lenskart, this would be Fidelity’s first investment in the company. Other early investors in Lenskart, such as TR Capital, KKR, and Avendus, may also consider divesting a portion of their holdings. However, SoftBank, the largest institutional investor with a 16.5% stake, will not be selling any shares in this round. The investment comes as Lenskart experiences rapid growth and profitability. The company is estimated to have closed FY24 with a revenue of Rs 5,500 crore, more than doubling its revenue from the previous year. The company is expected to maintain profitability in FY24, with audited financials yet to be filed. Lenskart operates approximately 1,500 retail outlets in India and has an online platform. In 2022, the company made a significant acquisition of Japan-based eyewear brand Owndays. Lenskart also invested $4 million in omnichannel eyewear brand Le Petit Lunetier in Paris. Lenskart’s CEO, Peyush Bansal, and Fidelity declined to comment on the matter, while a spokesperson for Temasek cited policy as the reason for not providing a comment.

Temasek, Fidelity May Invest $200 Million in Lenskart at $5 Billion Valuation

- April 26, 2024

TIS Staff

wp_ghjkasd_staff