BofA Global Research predicts that the European Central Bank will raise all three policy rates by 25 basis points at its upcoming meeting, citing a weaker growth outlook and no signs of a peak in core inflation. If the ECB does not hike next week, it could be the last hike of this cycle. BofA Global Research expects the first cut by the ECB in June 2024.

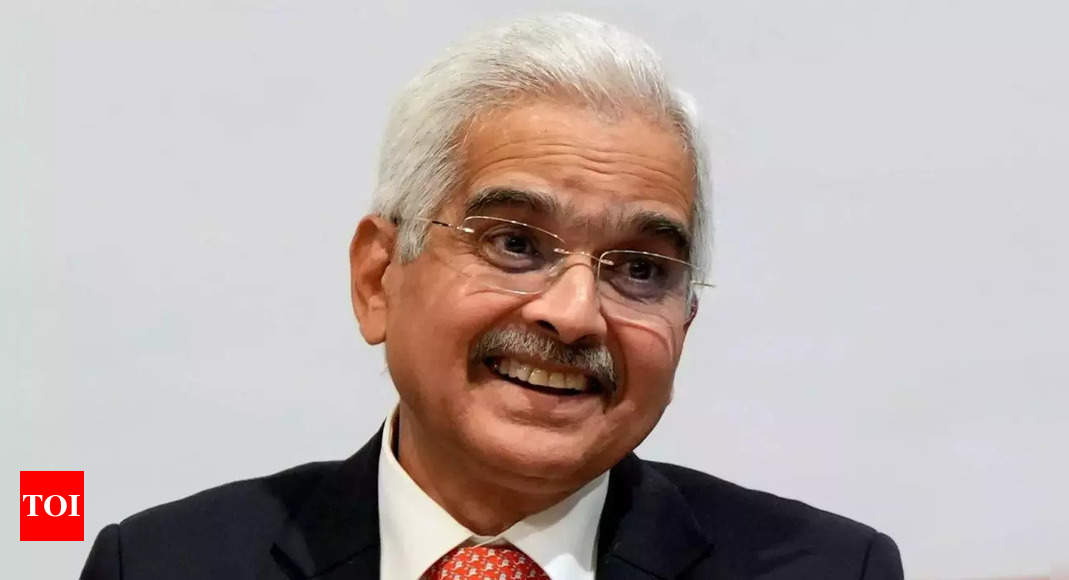

RBI governor Shaktikanta Das has emphasized the need for supply side interventions to address the impact of rising vegetable inflation, specifically tomato prices. Despite the easing of core inflation, headline inflation has increased due to spikes in vegetable prices. Das highlighted the importance of managing food prices and cautioned about the risks of recurring food price shocks. Read more to understand the governor’s perspective on the inflation outlook.